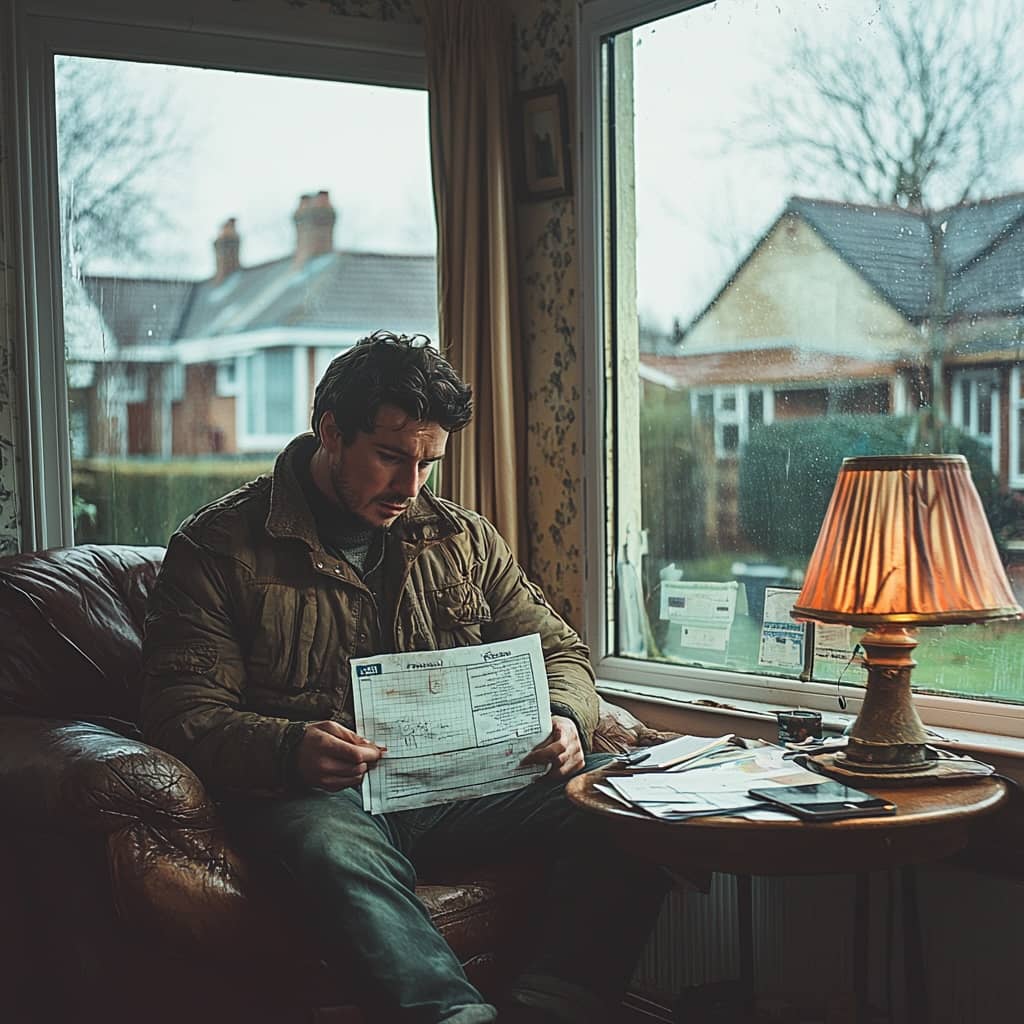

Facing the threat of repossession is a daunting experience for any homeowner. Falling behind on mortgage payments can lead to sleepless nights, constant worry, and the fear of losing your property. However, there are practical steps you can take to regain control of your financial situation. One such option is selling your house quickly, which could help you settle outstanding debts and avoid the repossession process altogether. This guide outlines the key steps and explains how Rescue Property Solutions Ltd can offer a fast and straightforward sale to prevent repossession.

Understanding the Repossession Process

Repossession occurs when your mortgage lender takes ownership of your home due to missed payments. In the UK, the process typically involves:

1. Missed Payments

Once you begin falling behind on your mortgage, your lender will contact you to discuss options or arrange a repayment plan.

2. Arrears Communication

If arrears continue, the lender may issue notices about your debt. This is when homeowners often start to feel overwhelmed.

3. Court Proceedings

If no resolution is reached, the lender may apply to the courts for a possession order. A court hearing date will be set.

4. Eviction

In the worst-case scenario, if the court grants a possession order and you cannot clear the debt, eviction can be enforced, and the property is repossessed.

For more detailed information on legal procedures, you can refer to the UK Government’s Repossession Advice.

Early Warning Signs

Being proactive is vital. Recognise the early warning signs that indicate repossession may be on the horizon:

• Multiple Missed Mortgage Payments: Even two or three consecutive missed payments can be a red flag.

• Mounting Debts: If you’re juggling various financial obligations and find it difficult to keep up.

• Threatening Letters: Any letters from your lender mentioning legal action should be taken very seriously.

• Rising Interest Rates: If interest rates are going up, your monthly payments may become unaffordable.

Immediate Actions to Take

1. Communicate with Your Lender

Engaging in open discussion can lead to revised payment plans or temporary relief measures. Avoiding contact often makes matters worse.

2. Review Your Budget

Identify ways to reduce non-essential spending so you can prioritise mortgage payments.

3. Check for Entitlements

See if you qualify for government schemes or benefits designed to help those at risk of losing their homes.

4. Explore Quick Sale Options

If paying off your arrears or reorganising finances is not feasible, a rapid property sale might be the best approach to avoid further legal action.

Why a Quick Sale Can Prevent Repossession

• Clearing Arrears: Selling your house fast allows you to settle your mortgage balance and any arrears before the lender proceeds with court action.

• Minimising Financial Damage: A repossession can severely impact your credit score, whereas a quick, voluntary sale helps maintain a better financial standing.

• Reducing Stress: Knowing you have a buyer in place and will soon have the funds to cover your debt can alleviate emotional pressure.

How Rescue Property Solutions Ltd Can Assist

Rescue Property Solutions Ltd is here to help UK homeowners avoid the turmoil of repossession by offering:

1. Fast Completion

We can conclude the buying process in as little as seven days, enabling you to repay your lender swiftly.

2. Fair Cash Offers

We assess your property and present a no-obligation cash offer based on current market conditions.

3. Guaranteed Sale

Once you accept our offer, the sale is secure—no risk of buyers pulling out or mortgage complications.

4. No Hidden Fees

We cover legal fees, and there are no estate agent commissions, ensuring the amount we offer is what you receive.

5. Flexible Timeframes

We tailor completion dates to your circumstances, helping you avoid repossession deadlines.

Conclusion

A repossession threat can feel overwhelming, but acting quickly can change the outcome. Selling your property through a reputable buyer like Rescue Property Solutions Ltd provides a swift, reliable way to clear your mortgage debts, protect your credit history, and avoid the stress of losing your home through legal proceedings.

If you’re facing repossession, contact Rescue Property Solutions Ltd today for a confidential discussion and a fast, fair cash offer on your property.

Rescue Property Solutions Ltd is dedicated to assisting UK homeowners in preventing repossession by offering a transparent, quick sale option that meets your unique circumstances.